The biggest proposal Mr. Sali came up with has to do with cutting the payroll tax; he initially floated this at a Labor Day picnic here in Meridian (two reports on this picnic can be found here and here). I was amazed at what he said the result of this cut would be; first, though, I should provide a little background information:

Back in the second season of South Park, one of the funnier episodes was called "Gnomes"; it features a group of gnomes (duh!) with an stunning business plan, to wit:

1. Collect underpants

2. ????????

3. Profit!

Back to Mr. Sali's plan to cut the payroll tax -- here's what his press release says:

“Cutting payroll taxes will stimulate the economy and will provide real and immediate relief to the working Americans,” Sali told a crowd gathered at a Meridian park for a Labor Day picnic sponsored by the Sali campaign. Representative Sali noted that his plan will also protect Medicare and Social Security for every generation.[Emphasis mine] Wow! That's pretty impressive. Let's look at this in terms of the gnome's business plan:

1. Cut payroll tax

2. ????????

3. Protect Medicare and Social Security for every generation!

I'm not quite sure that this works from a macroeconomic point of view. At some point in my lifetime, Social Security is going to reach a crisis point, as Rep. Bob Beauprez (R-CO) points out in this speech. By 2040, there will be only two workers for each beneficiary; the worker/beneficiary ration will start dropping quickly in 2008, when the first baby boomers start turning 62. It doesn't make any sense to anyone, except maybe Mr. Sali, how we can lower payroll taxes, have fewer people paying in for more beneficiaries, and not cut benefits or raise the retirement age. And seriously -- while cutting the payroll tax might result in short-term economic stimulus, does Mr. Sali really think that it would be enough to "protect Medicare and Social Security for every generation"? I'd need to see some numbers on that claim. (And c'mon -- if payroll tax cuts, obviously a popular item, were really going to be able to fix everything, don't you think President Bush would have proposed them? Or does Mr. Sali think he's smarter than President Bush and Vice President Cheney on this matter? Or is it more likely that they've done the math and realize it's an unreasonable proposal?)

This demonstrates a problem that Mr. Sali's opponent, Larry Grant, will have in this race. Larry is a successful businessman, and seems unable to say something completely ridiculous just because he thinks it would make a good sound bite. Another of Mr. Sali's press releases says that Larry has "vowed to raise" payroll taxes, and he provides a link to Larry's answers to a questionnaire at Project Vote Smart. (Interestingly, Mr. Sali has himself so far refused to fill out the same survey -- as I said, he apparently doesn't want anyone to know any specifics about his ideas.) I read Larry's responses as indicating actions he would take to save Social Security in its present form for the long term -- he's not calling for an immediate increase in payroll taxes. He's a smart guy, he's looked at the math, and he knows that if we don't increase the amount of money going into the system, or raise the retirement age, increased life expectancy and the declining birth rate of the last 40 years will result in insolvency unless action is taken -- action that doesn't involve just cutting payroll taxes.

At the end of the press release about payroll tax cuts, Mr. Sali says that “My opponent’s positions clearly demonstrate he is no moderate. He is a liberal.” I find this very interesting -- none other than Howard Dean had a similar proposal to Mr. Sali's in the last presidential campaign. If Mr. Sali agrees with Gov. Dean, then where does that put him on the liberal/conservative scale? (Yes, I know that's not a fair comparison, but I think it shows that Mr. Sali's seemingly simplistic view of what is liberal and what is moderate isn't really accurate.)

I'm looking forward to any more specific proposals Mr. Sali comes up with -- like exactly what government spending he plans to cut that would allow him to balance the budget without raising taxes, remembering that non-defense discretionary spending makes up only about $600B (a little under 25%) of the budget -- or does he plan on cutting defense spending as well? The current budget deficit is on the order of $300B; will he cut non-defense discretionary spending in half? Does he realize that that would be politically impossible? Once again, his sound bites don't match up to any version of reality with which I'm familiar.

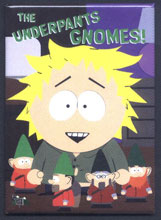

Update 2307 07 Sep: Larry Grant himself responds to Mr. Sali's "challenge" on payroll taxes much more eloquently than I did -- which explains why he's the one running for Congress. And since I'm updating, it gives me a chance to post a picture of the Underpants Gnomes for those who don't know what they look like:

It just occurred to me -- it would be fairly easy for some devious person with Photoshop "skillz" to replace Tweek's face with a picture of Mr. Sali...

It just occurred to me -- it would be fairly easy for some devious person with Photoshop "skillz" to replace Tweek's face with a picture of Mr. Sali...Update 0013 08 Sep: If Mr. Sali gets elected, I'm probably going to get in really big trouble for this: